Background

My journey in crypto started just before the crypto bull run of 2017. I was a noob and made a lot of mistakes along the way. Crypto is hard to understand and requires patience and motivation. No one can force-feed crypto to you and understand it for you. Hopefully, this will help spark your interest in crypto and give you some tools needed for success.

A few years ago, I met a car friend in his late 20s. He was always free to hang out and lived a great life. However, I later found out that he was effectively retired. Due to his life decisions, he could live off the hard work and income he had made in the past. This intrigued me because I never considered that at such an early age, I could stop working and live a comfortable life if I reached a certain level of savings.

Since then, I have started to take investment more seriously to reach early retirement. I realized that crypto is one of the ways for someone in our generation to make a much greater return than traditional investing.

Why?

To understand the long-term potential of crypto and bitcoin, I recommend reading: The Bullish Case for Bitcoin. It is a long read, but it summarizes why I believe in crypto for the long term. I have outlined some of the key points below.

If Bitcoin is exceptionally successful and becomes the dominant payment system used throughout the world. The currency’s value should equal the total value of all the wealth in the world. The current estimates of worldwide household wealth are $100 trillion to $300 trillion. With 21 million BTC available, each coin would be worth USD 10 million.

Even if bitcoin were not to become a fully-fledged global money and compete with gold as a non-sovereign store of value, it is still severely undervalued. For example, the market cap of the above-ground gold supply (~ 8 trillion USD) compared to 21 million BTC gives a value of USD 380,000 per BTC.

The article discusses why BTC is superior to gold in every extent of consideration other than established history. As time passes, established history will not be a competitive advantage for gold. Therefore, it is not unreasonable to expect BTC to approach or surpass gold’s market capitalization in the next decade.

This scenario is a 23x ($380,000 / $16,000) return from today’s BTC price (~$16,000 USD, December 29, 2022). So a dollar invested today is 23 dollars in five to ten years.

We are only talking about Bitcoin here; now, imagine the use cases that other cryptocurrencies have and if they become successful. Owning Bitcoin and crypto is one of the few asymmetric bets in which people worldwide can participate. The investor’s downside is limited to the money invested, but the upside is still 100x or more.

My Strategy (Log Curve, DCA)

Investment should be manageable and take only a little of my time. I have found success in day trading but found the reward not worth the stress it involves. I would instead focus on my life and work rather than constantly think about investing. The solution I found is long-term investing. Then, I came across the Bitcoin logarithmic chart. I now religiously follow this chart to make my investment decisions.

This is the Bitcoin logarithmic graph from 2012 – today. You can notice a few things. (1) Bitcoin has cycles where the price goes to a new high. Using these cycle data, these ‘buy’ and ‘sell’ regions were created. (2) You can also see that the price currently is below the predicted bottom. This is because these buy and sell zones were made based on limited data and will continue to improve as we have more price action data. During 2020, the price also fell below the predicted levels, which the model now accounts for.

My strategy is to buy when BTC hits the green buy zones and start selling whenever the price reaches the red sell zones. I use the BTC price as an indicator for the entire crypto market.

The idea is to take advantage of the cyclical nature of Bitcoin and the crypto market and have exponential growth on your investment. During the bull market, you will grow your fiat investment through crypto investment. Then, you will take those gains in a bear market and increase your crypto holdings. You will keep repeating until retirement.

I have found that even if you can sell near or at the peak, it is challenging to buy back into an investment that keeps going down in value. The solution I have found is to dollar cost average (DCA) into my investments.

Ever since bitcoin hit the green buy levels in the LOG model, I have started dollar cost averaging back into the crypto market. I do this mindlessly without any thought. Once a week, I have an auto-buy that purchases a predefined amount of crypto. Of course, this amount will depend on your risk tolerance and income.

Always put in money you are comfortable with losing.

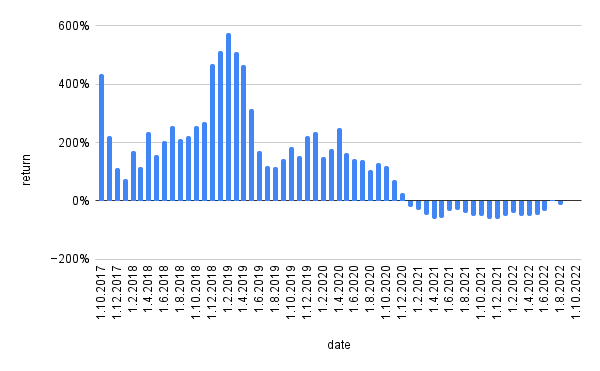

This graph illustrates the returns I’ve had from DCA-ing since 2017. Each bar represents bitcoin purchases. You can see the returns on the left in percentage.

You can see that I am at a negative return for this entire ‘buy’ level in 2022. This is something that I am okay with. I always go back to the log curve and remind myself of the past – I would not care if I bought bitcoin at $300 vs. $3,000. Having the mindset that I will be able to buy at the bottom invariably would make me miss the boat.

This way, I can forget about the market and know everything is going according to plan. This definitely helps me focus on my day-to-day work and my mental health. Why would you care about short-term price action if you have a long-term view?

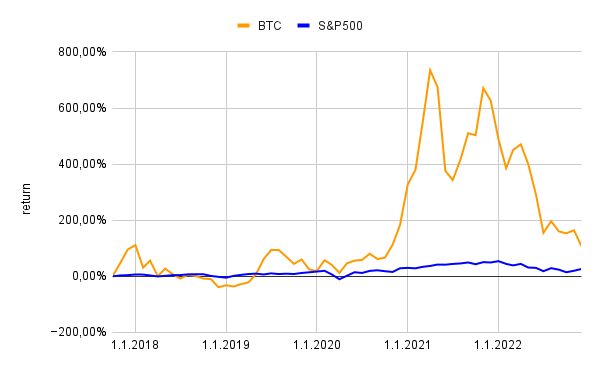

Let’s compare the performance of my crypto saving strategy vs. a traditional approach of putting similar amounts into S&P each month.

My bitcoin DCA strategy has given me ~160% returns for the total money I put in. Whereas the S&P strategy would provide a 20% return on my capital. My BTC strategy is roughly 10x better than the S&P strategy, even during a brutal bear market.

Analyzing Riskier AltCoins

Bitcoin is one of many cryptocurrencies I have been investing in. Similar long-term value cases apply to AltCoins, defined as any cryptocurrency other than Bitcoin. Some cryptocurrencies will have returns greater than Bitcoin, and some will be less.

You can go to coinmarketcap.com to view all the different cryptocurrencies available by their market capitalization size.

My portfolio currently has a split of 50% Bitcoin, 30% Ethereum, 10% Cardano, and 10% other riskier cryptocurrencies. My Bitcoin, Ethereum, and Cardano investments are made through auto-purchases, as mentioned above. The last 10% of other riskier cryptocurrencies are done manually on a weekly or monthly basis.

I will outline my analysis process of these riskier cryptocurrencies:

- I like to keep my investments within the top 100 cryptocurrencies (ranked by market cap).

- I read about what the project wants to achieve, their white paper, and how far they are in that process. I will also take a look at their Reddit community or discord server.

- Based on these factors, I like to analyze what the future price of this coin looks like.

To do this, I take the coin’s total supply and compare it to what I believe the future market cap of the currency could be.

Let’s use Aave as an example. Currently, Aave is trading at $54.25. With a maximum circulating supply of 16 million and 14 million currently in circulation. The market cap is $764 million. So the current price is calculated as 764 million / 14 million = $54.25. If Aave becomes a 10 billion dollar market cap, it would mean that each Aave would be worth $709 at the current supply of coins. If Aave gets as big as Bitcoin, the price would be $22,406. If Aave gets as big as Ethereum, the price would be $10,100.

The market cap analysis helps me put my thoughts into a number. Where do I get the number for how big a currency could be? I draw similarities to existing companies doing similar things. For example, suppose the cryptocurrency is trying to solve online storage issues. In that case, I will look at the market cap of DropBox. With this, I can create best-case and worst-case scenarios of the future price.

If the alt-coin has a more significant growth potential than bitcoin, Ethereum, then I will invest (> 25x return). However, if I find that the growth potential is similar to bitcoin, I should keep my money in Bitcoin.

My riskier investments generally lose money, but I will hit a home run every now and then, and it will make up for the rest of the bad-performing risky investments I have made.